Zone, a Nigerian startup company primarily focused on blockchain technology to facilitate payments for banks and fintech companies, has successfully raised $8.5 million in its first-ever venture capital funding round to further propel its innovative initiatives.

This is an outstanding achievement for the company which transitioned into an independent entity in 2022 after operating under its parent company, Appzone.

Led by Flourish Ventures and TLcom Capital, with additional investments from prominent blockchain-focused VC firms including Digital Currency Group, Verod-Kepple Africa Ventures, and Alter Global, the company is gearing up to position itself as a frontrunner in Africa’s fintech industry.

As Zone looks to the future, it aims to extend its blockchain network across Africa, with plans to conduct pilot programs to test its cross-border capabilities and launch remittance products in 2025.

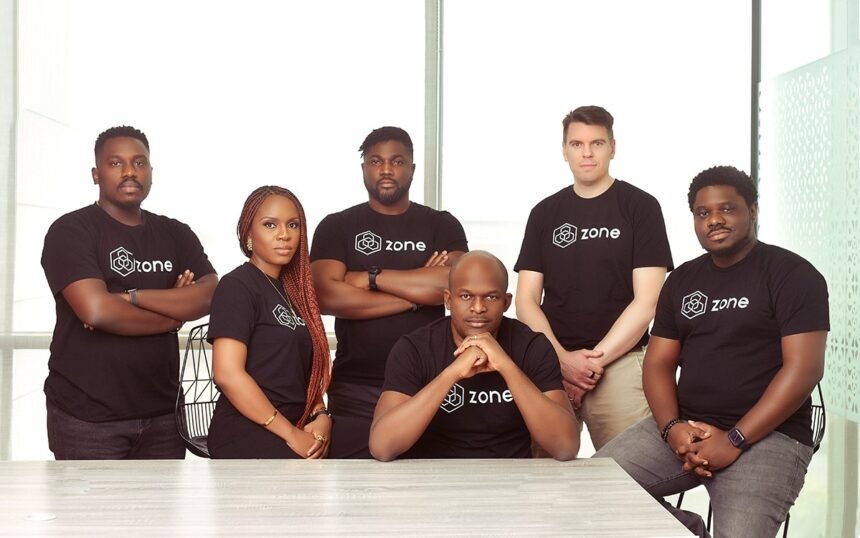

Obi Emetarom, CEO and co-founder of Zone highlighted the importance of external funding to drive the company’s growth trajectory following its transition from its parent company. He emphasized the need for capital infusion to support ongoing expansion efforts and further development of its blockchain network.

With the newly secured funding, Zone plans to expand its network coverage domestically and forge more connections with banks and financial services providers.

Zone boasts an impressive client base, with over 15 of Africa’s largest banks and fintech companies utilizing its network for payment processing. Among its clients are major players in the Nigerian banking sector, including Access Bank Plc, Guaranty Trust Bank Plc, and United Bank of Africa.

Ameya Upadhyay, Partner at Flourish Ventures, expressed optimism about Zone’s potential to drive payment innovation not only in Africa but also on a global scale. He noted the significance of Zone’s technology in advancing the efficiency and accessibility of payment systems.

The company is also making plans to enhance its technology, particularly focusing on instant settlements, and explore additional use cases for its blockchain network beyond traditional ATM transactions.

And not just that, Zone aims to provide robust API solutions for financial institutions, enabling seamless integration of payment applications.

Despite the challenging fundraising environment for African startups, Zone’s successful funding round demonstrates investor confidence in its unique value proposition and the expertise of its founding team, who bring extensive experience from the banking industry.

The company(Zone) remains focused on building out its capabilities domestically before expanding into new markets.