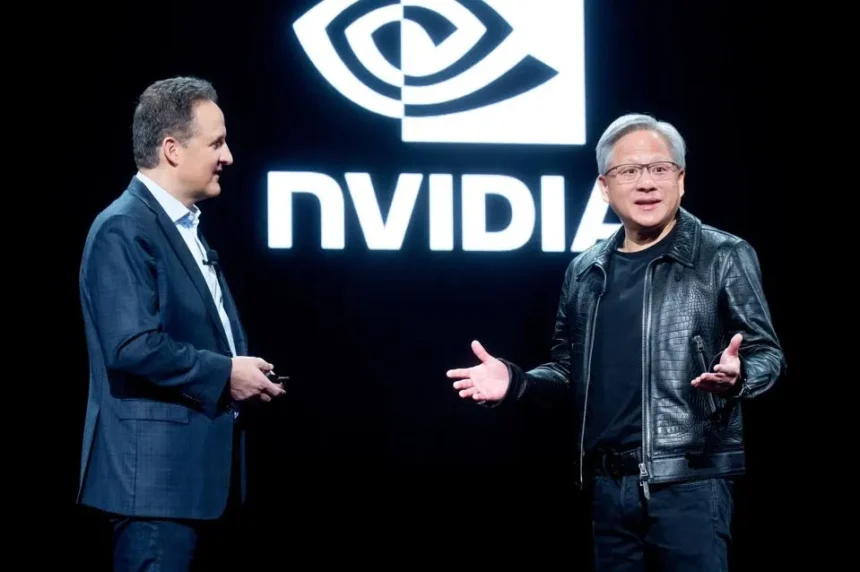

On Tuesday, March 18, 2025, Nvidia CEO Jensen Huang delivered an unscripted two-hour keynote at the GPU Technology Conference (GTC) in San Jose, California, leaving no doubt about his core message: the fastest chips win. Addressing a packed crowd of 25,000 attendees—plus millions online—Huang argued that Nvidia’s next-gen GPUs, like the Blackwell Ultra, Rubin Next, and Feynman, will slash AI costs and fuel a decade of explosive growth. With cloud giants already snapping up millions of chips and a $500 billion AI chip market in sight by 2028, here’s how Huang’s vision unfolded and what it means for Nvidia’s future.

The Speed Imperative: “Best Cost-Reduction System”

Huang’s central thesis? “Speed is the best cost-reduction system.” In a post-keynote chat with journalists, he predicted that over the next 10 years, dramatic performance gains will outpace cost concerns for AI infrastructure. He spent 10 minutes during the keynote breaking down the economics with back-of-the-envelope math, focusing on “cost per token”—the price of generating one unit of AI output. Faster chips, he argued, serve more users simultaneously, boosting data center revenue and ROI.

Take the Blackwell Ultra, set for release in H2 2025: Nvidia claims it delivers 50 times the revenue potential of its Hopper predecessor by churning out tokens 40x faster for the same power envelope. “Questions about cost and return on investment go away with faster chips,” Huang told reporters, addressing hyperscalers’ minds directly. With each Blackwell GPU priced around $40,000 (per analyst estimates), speed justifies the spend.

Cloud Giants All In: 3.6M Blackwell GPUs Sold

The four biggest cloud providers—Microsoft, Google (Alphabet), Amazon (AWS), and Oracle—have already bought 3.6 million Blackwell GPUs in 2025, up from 1.3 million Hoppers in 2024, under Nvidia’s new “two-GPUs-in-one” counting convention. That’s a $144 billion haul at $40,000 apiece, signaling unrelenting demand despite investor jitters over capex pacing. Posts on X echo this: @snikhs2 noted Nvidia’s shift to “25x more AI performance in the same power envelope,” projecting a 900x leap by 2027.

Huang revealed roadmaps for Rubin Next (2027) and Feynman (2028) chips because “several hundred billion dollars of AI infrastructure” is already in planning. “They’ve got the budget approved, the power approved, the land,” he said, framing Nvidia as the linchpin for data centers morphing into “AI factories.” Amazon’s AWS, Google Cloud, and Microsoft Azure will be first to deploy Blackwell Ultra, per Nvidia’s release.

Dismissing the ASIC Threat

Custom AI chips (ASICs) from cloud providers—like Google’s TPUs or Amazon’s Trainium—don’t faze Huang. “They’re not flexible enough for fast-moving AI algorithms,” he said, adding, “A lot of ASICs get canceled. The ASIC still has to be better than the best.” Nvidia’s GPUs, with their adaptability and CUDA ecosystem, remain the gold standard. Posts on X align: @Josman31416 called Nvidia’s “unrelenting innovation cycle a strategic masterstroke,” leaving rivals scrambling. Huang’s focus? Ensuring those $100 billion-plus projects pick Nvidia’s latest—like the MI325X (Q1 2025) or Rubin’s HBM4-powered leap.

The Bigger Picture: AI’s Next Decade

Huang’s keynote wasn’t just about chips—it was a manifesto for AI’s evolution. He highlighted robotics (e.g., Isaac GR00T N1 for humanoid bots), autonomous vehicles (a GM partnership), and “agentic AI” that reasons, not just generates. The Blackwell Ultra’s 288GB memory and 1.5x performance over its predecessor targets these frontiers, while Rubin (2026) and Feynman (2028) promise exponential gains. “The computational requirement for reasoning is 100x more than we thought last year,” he told Business Insider, countering fears of slowing chip demand.

Yet, Nvidia’s stock dipped 3.4% post-keynote, reflecting tariff worries and DeepSeek’s inference efficiency claims. Huang shrugged off short-term noise, telling CNBC Wednesday that Trump’s tariffs won’t derail AI’s “foundation for every industry.” With $39.3 billion in Q4 2024 revenue (up 78%), Nvidia’s betting long-term growth trumps volatility.

What’s Next for Nvidia?

Huang’s GTC vision—faster chips, bigger markets—faces tests. Can Blackwell Ultra’s H2 rollout and Rubin’s 2026 debut keep cloud spending torrid? Will ROCm erode CUDA’s developer lock-in versus AMD? Q1 earnings (May 2025) will gauge Blackwell’s ramp-up, but Huang’s unscripted confidence—“no net, no teleprompter”—suggests Nvidia’s ready to double down. As he put it: “What do you want for several $100 billion?” For now, the answer’s clear: Nvidia’s fastest.