Nvidia, the U.S. chip powerhouse, is sounding the alarm over intensifying competition from Huawei, despite stringent U.S. restrictions hobbling the Chinese tech giant.

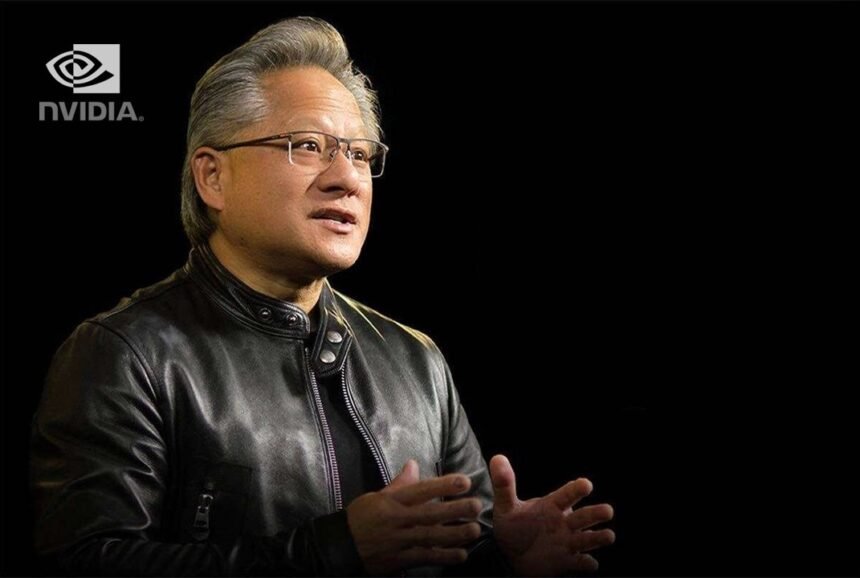

In its annual filing on February 26, 2025, Nvidia named Huawei a key rival for the second consecutive year, a stark shift from its absence on the competitor list for at least three prior years. CEO Jensen Huang underscored this threat in a CNBC interview with Jon Fortt, noting, “There’s a fair amount of competition in China—Huawei and others are vigorous and very competitive.”

As Huawei rebounds with innovative chips and a self-developed ecosystem, Nvidia faces a formidable challenge in a market altered by sanctions. Here’s how this rivalry is unfolding.

Huawei Emerges as a Multi-Category Competitor

Nvidia’s filing highlights Huawei as a contender across four of five key segments: chips, cloud services, computing processing, and networking products. This broad overlap signals Huawei’s aggressive push into AI and semiconductor spaces traditionally dominated by Nvidia.

Since 2019, U.S. export controls have barred Huawei from accessing advanced American tech, including 5G chips and Google’s Android OS. Yet, far from faltering, Huawei has pivoted to homegrown solutions, posing a direct threat to Nvidia’s foothold in China—a market that once drove twice the revenue it does now, per Huang’s remarks.

Huawei’s resurgence is evident in its 2024 revenue of 860 billion yuan ($118.27 billion), up 22% from 2023—the fastest growth since 2016, per state media and CNBC calculations. This rebound follows a brutal 29% revenue drop in 2021, driven by sanctions that crippled its consumer arm. Today, Huawei’s innovations are rekindling its competitive edge.

SEO Keywords: Nvidia Huawei competition 2025, AI chip market China, U.S. sanctions Huawei, Jensen Huang CNBC

Huawei’s Smartphone Revival Fuels Chip Ambitions

Huawei’s comeback kicked off in 2023 with the Mate 60 Pro, a smartphone delivering 5G-like speeds thanks to an advanced domestic semiconductor, defying expectations under U.S. restrictions. By late 2024, the Mate 70 series debuted with HarmonyOS NEXT, Huawei’s first fully self-developed OS, severing ties with Android.

These milestones showcase Huawei’s ability to innovate under pressure, bolstering its Ascend AI chip line, which now powers over 30 large language models in China’s AI boom.

While Huawei’s consumer revenue rose 17% to 251.5 billion yuan in 2023, it’s still half its 2020 peak.

Yet, its 2024 growth, projected at 860 billion yuan when Huawei releases its March report, suggests a robust recovery, with chips and cloud services amplifying its challenge to Nvidia.

SEO Keywords: Huawei Mate 70 HarmonyOS, Ascend AI chips, China smartphone market 2025, Nvidia revenue decline

Nvidia’s China Conundrum

Huang’s CNBC comments reveal the toll of U.S. export controls, implemented since October 2022 to curb China’s access to cutting-edge chips. “Revenue in China before export controls was twice as high as it is now,” he said, reflecting a “substantially lower” business outlook shared by CFO Colette Kress in recent earnings.

Nvidia has countered with China-specific chips like the H20, but these downgraded models face stiff competition from Huawei’s Ascend 910 series, which some sources claim outpace Nvidia’s offerings in key metrics.

China’s $7 billion AI chip market, once 90% Nvidia’s domain, is now a battleground. Huawei’s ability to ship over 1 million Ascend chips in 2025, per industry estimates, underscores its growing clout, fueled by a national push for self-sufficiency under President Xi Jinping.

Implications for the AI Race

Huawei’s ascent isn’t just a China story—it’s a global one. U.S. sanctions aimed to stifle its tech ambitions, but Huawei’s innovations signal resilience, challenging Nvidia’s dominance in AI hardware.

For Nvidia, retaining market share means navigating a “very competitive” landscape, as Huang put it, while balancing compliance with U.S. rules. For Huawei, it’s a chance to reclaim ground lost since 2019, leveraging its home market advantage.

Will Nvidia adapt its strategy, or will Huawei carve out a lasting edge? As China’s AI ecosystem matures, this rivalry could redefine the global semiconductor pecking order. Share your take below.