Nvidia’s reign in the $3 trillion market cap club came to an abrupt end on Thursday, February 27, 2025, as its shares plunged over 8% following its latest earnings report. The chipmaker shed roughly $273 billion in value, bringing its market capitalization to $2.94 trillion. This leaves Apple as the sole member of the elite $3 trillion club among U.S. tech giants. The broader market felt the sting too, with the S&P 500 dipping 1.6% and the Nasdaq sliding 2.8%.

Despite the drop, Nvidia remains the second-most valuable U.S. tech company, trailing Apple but staying ahead of Microsoft—one of its top customers. So, what’s behind this tumble, and can Nvidia’s AI juggernaut bounce back? Let’s dive in.

Q4 Earnings: A Beat Marred by Market Jitters

Nvidia’s fiscal Q4 results, released Wednesday, were a blockbuster on paper. Revenue soared 78% year-over-year to $39.33 billion, topping analyst expectations. The data center segment, fueled by Nvidia’s market-leading GPUs for AI workloads, skyrocketed 93% to nearly $36 billion. Earnings also beat forecasts across the board. The company even signaled a robust start to fiscal 2026, with production kinks for its next-gen Blackwell chip largely ironed out.

Yet, the market wasn’t impressed. Shares tanked as investors fretted over headwinds: U.S. export controls, potential tariffs, the rise of more efficient AI models, and a perceived slowdown in Nvidia’s once-explosive growth. Year-to-date in 2025, Nvidia’s stock is down 10%, a stark contrast to its fivefold value surge since the generative AI boom kicked off two years ago.

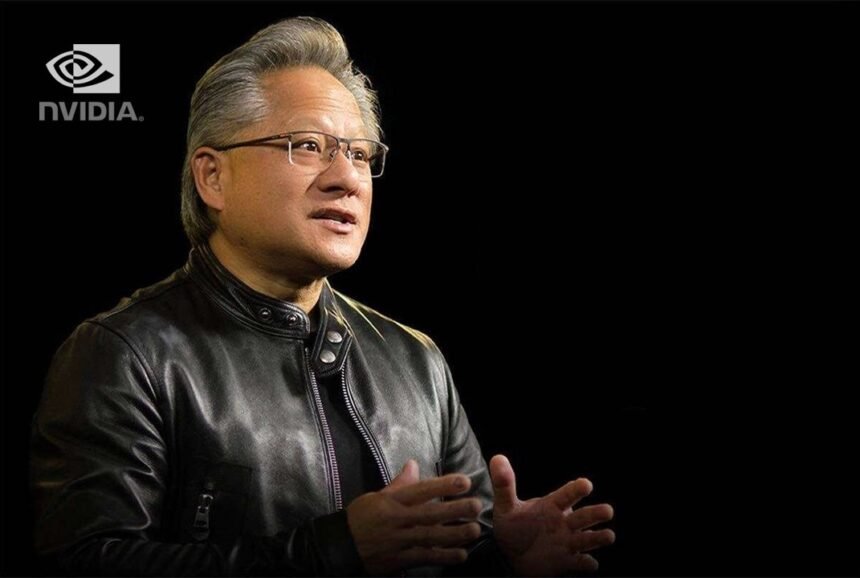

AI Demand Still Strong, Says CEO Jensen Huang

Nvidia CEO Jensen Huang remains unfazed. In a Wednesday interview with CNBC’s Jon Fortt, he doubled down on the insatiable demand for Nvidia’s chips. Next-gen AI models that “reason step-by-step” to answer questions require “100 times more computation” than earlier systems, Huang said. This positions Nvidia as a linchpin for tech giants like Microsoft, Google, and Amazon, which drive about half of its data center revenue through billions in annual infrastructure spending.

Nvidia’s $4.1 billion AI server backlog (noted in Dell’s recent earnings) and deals with firms like xAI further underscore its dominance. Posts on X even speculate about Nvidia’s role in powering AI breakthroughs in 2025, though export limits to regions like China remain a thorn in its side.

From $3 Trillion to $2.94 Trillion: A Reality Check

Nvidia first hit the $3 trillion milestone in June 2024, riding the AI wave alongside Apple and Microsoft. Thursday’s slide marks its exit from that rarified air, but context matters: at $2.94 trillion, it’s still a titan, dwarfing its valuation from two years ago. The drop reflects less a failure of fundamentals and more a recalibration of sky-high expectations in a jittery market.

What’s Next for Nvidia in 2025?

Nvidia’s growth engine—AI chips—shows no signs of stalling, with Blackwell’s rollout and hyperscaler demand poised to fuel fiscal 2026. Yet, external pressures like tariffs and competition from leaner AI models could cap its upside. Apple, meanwhile, holds the $3 trillion crown alone, with Microsoft ($2.8 trillion as of late 2024) lurking close behind.

Can Nvidia reclaim its spot among the $3 trillion elite? With Huang’s bullish outlook and a still-hot AI market, it’s too early to count them out. Keep watching for updates on Nvidia’s stock, AI innovations, and the tech sector’s next moves.