After a Federal High Court sitting in Abuja two days ago where Binance representative Ayodele Omotilewa presented a non-guilty plea to Judge Emeka Nwite, the Court declared that the Binance Tax evasion trial will commence on October 11, 2024.

Binance did aid and abet those subscribers on your trading platform to unlawfully refuse to pay taxes or neglect to pay those taxes, and in doing so committed an offense contrary to the provisions of S.94 of the Companies Income Tax Act (as amended).

The document reads.

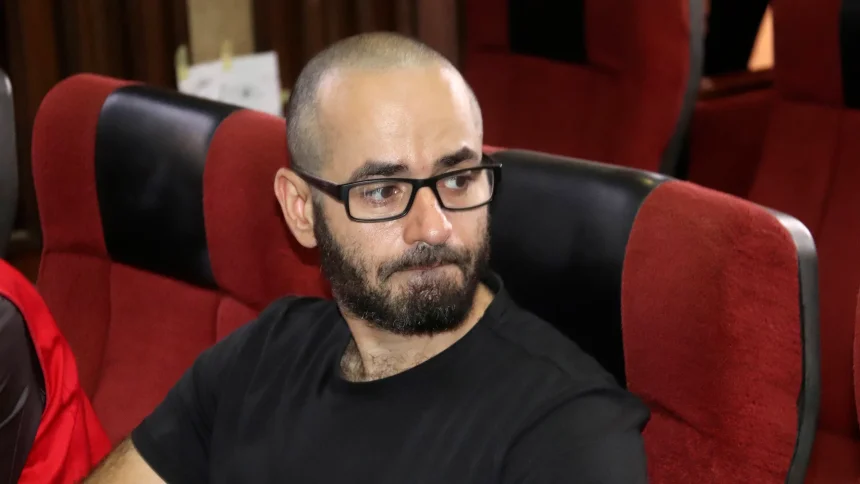

The exchange will face four counts of tax evasion, including the crypto exchange’s failure to register with the Nigerian Federal Inland Revenue Service for tax purposes. Please note that the Abuja Federal High Court had earlier dropped the charges against the two detained executives, Nadeem Anjarwalla, and Tigran Gambaryan, from the FIRS tax evasion case against Binance.

The reason for the recent ruling follows an amendment to the previous charges against the crypto exchange. A few days ago at the proceedings, the counsel for Binance, Tonye Krukrubo (SAN), expressed to Judge Emeka Nwite that the company has forwarded the name of its official representative in the case to the FIRS and the court. The Counsel for the FIRS, Moses Idehu, acknowledged the notice and requested the court’s permission to swap all previous charges with the amended version.

According to the fresh charges, Binance is the sole defendant in the case, which implies that both executives are no longer in association with the case. The new charges accuse Binance of enabling the buying and selling of cryptocurrencies, remittance, and transfer of said assets to Nigerians without deducting the Value Added Tax (VAT) from the transaction.