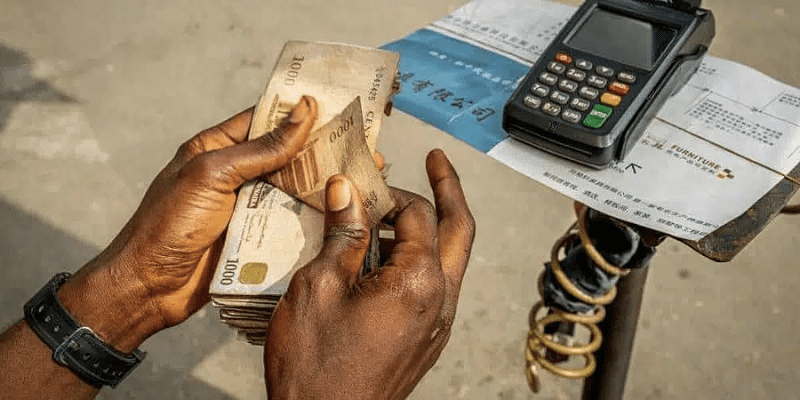

Following a directive from the Central Bank of Nigeria (CBN) on Tuesday, Point of Sale (POS) banking agents in Lagos are grappling with new cash withdrawal limits by raising their fees. The CBN has set a daily withdrawal cap of ₦1.2 million per POS agent and limited individual customer withdrawals to ₦100,000.

Impact of New Regulations

The CBN’s latest move aims to rein in POS agents, who have become essential providers of cash amidst a cash scarcity crisis that began in 2023. Semiu Ajayi, a POS agent from Gbagada, expressed surprise at the decision, stating, “I’ll just increase my withdrawal charges. It used to be ₦4,000 for a ₦100,000 withdrawal, but now I’ll charge ₦6,000 or more.” This indicates that agents may shift the financial burden onto customers to mitigate the impact of reduced business.

POS agents play a vital role in Nigeria’s financial inclusion strategy, especially as many citizens have faced difficulties accessing cash through traditional banking channels, such as ATMs and in-branch services. The increased reliance on these agents is largely attributed to a failed currency redesign in 2023, which led to a prolonged shortage of physical cash.

Criticism and Challenges

While POS agents have filled a critical gap in cash distribution, they have faced criticism for high transaction fees and for fostering a reliance on cash, which contradicts the CBN’s objectives for a cashless economy. These latest regulations will pressure the approximately 2 million agents operating in Nigeria.

Shade Raheem, a POS agent in Ikeja, raised concerns about the sustainability of their business under the new rules: “How will we survive with this new CBN policy? They just want to push customers to the banks.”

Adaptation Strategies

Despite the challenges, some POS operators are optimistic about adapting to the new environment. Tade Oluwanisola, a POS agent in Ikorodu, mentioned plans to acquire more terminals to handle increased demand. “Not every customer will withdraw up to their limits daily, so we will spread the demand across multiple terminals,” he noted.

Regulatory Context

The CBN claims that the new withdrawal limits aim to tackle issues such as fraud prevention, standardization of operations, and regulation of the agency banking sector. The growing dependence on POS agents has led to calls for tighter oversight, prompting the CBN to require POS operators to register with the Corporate Affairs Commission (CAC) by September 2024.

The CBN stated, “The CBN will conduct oversight of the aforementioned actions, including impromptu backend checks, to ensure compliance. Any breach of these directives will attract appropriate penalties, including monetary fines and administrative sanctions.”

Conclusion

The CBN’s new cash withdrawal limits represent a significant shift in the operational landscape for POS agents in Nigeria. Although these regulations aim to enhance oversight and promote a cashless economy, the challenging environment forces agents to navigate difficulties impacting their business models and customer relationships. As they adapt to these changes, the future of POS banking in Nigeria remains uncertain.