On Friday, March 14, 2025, Klarna, the Swedish fintech pioneer of buy now, pay later (BNPL) loans, filed its IPO prospectus with the SEC, setting the stage for a public debut on the New York Stock Exchange under the ticker symbol KLAR. While the company has yet to disclose the number of shares or price range, analysts peg its valuation at around $15 billion—a remarkable recovery from its $6.7 billion low in 2022. This move marks Klarna’s resurgence and tests the waters for tech IPOs in a jittery U.S. market. Here’s why this listing matters and what’s at stake for the BNPL trailblazer.

A U.S. Listing Over Europe: Strategic Advantage or European Loss?

Klarna’s decision to list on the NYSE deals a blow to European exchanges, which have struggled to keep pace with the U.S. in attracting tech giants. CEO Sebastian Siemiatkowski has long hinted at a U.S. preference, citing greater visibility and regulatory clarity. “The U.S. offers better advantages for fintech growth,” he noted in past interviews, a sentiment echoed by Spotify’s 2018 NYSE debut. With 37 million U.S. customers and a 38% revenue spike in the market last year, Klarna’s focus on American expansion makes this a logical step—though it underscores Europe’s challenge in retaining its tech stars.

From Boom to Bust to Bounce-Back

Klarna’s journey has been a rollercoaster. Valued at $46 billion in a 2021 SoftBank-led round during the pandemic e-commerce boom, it plummeted 85% to $6.7 billion by 2022 amid rising interest rates and a fintech reckoning. Yet, 2023 marked a turnaround, with profitability restored and 2024 revenue soaring 24% to $2.8 billion. Operating losses shrank to $121 million, while adjusted operating profit hit $181 million—up from a $49 million loss in 2023. Analysts now estimate a $15 billion valuation, fueled by Klarna’s 93 million active users and a BNPL market projected to hit $160 billion by 2032.

Timing the Market: Opportunity or Risk?

Klarna’s filing comes as tech IPOs creep back after a drought since late 2021, when inflation and rate hikes spooked investors. Recent debuts—Reddit in October 2024, ServiceTitan in December, and CoreWeave earlier this month—suggest a thaw, but volatility looms. The Nasdaq’s four-week slide, ending Thursday at a September low before a Friday rebound, reflects tariff-related unease under the second Trump administration. Friday’s University of Michigan data showed consumer sentiment dipping to 57.9 in March, below the expected 63.2, adding pressure. Klarna’s success hinges on navigating this choppy backdrop.

Competing in a Crowded BNPL Arena

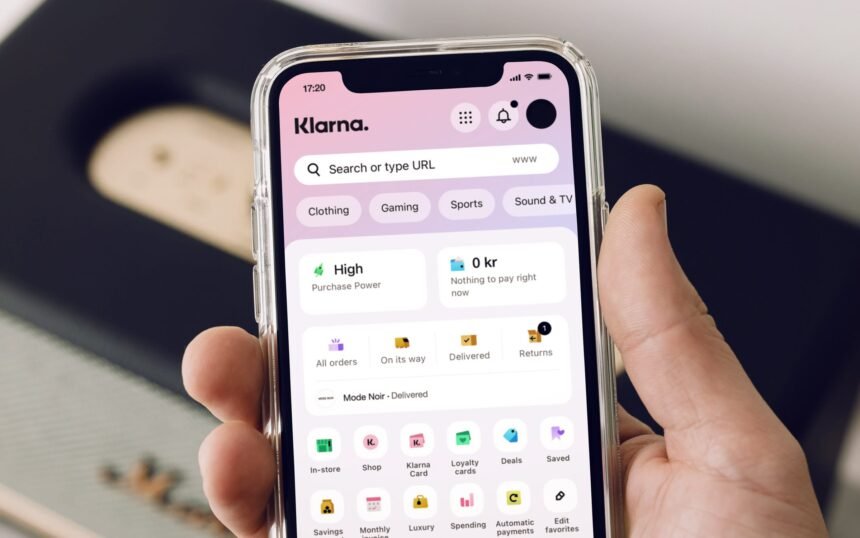

Founded in 2005, Klarna’s BNPL model—splitting purchases into interest-free installments—reshaped online shopping, boasting partnerships with 575,000 merchants like Nike and Airbnb. But competition is fierce. Affirm (public since 2021), Afterpay (acquired by Block for $29 billion in 2022), and PayPal dominate, while banks like JPMorgan Chase, Citigroup, and Bank of America, plus card networks Visa and Mastercard, vie for share. Digital banks like Revolut and Nubank also loom. Block’s recent FDIC approval for direct loans via Square Financial Services ups the ante. Klarna must lean on competitive rates and incentives to stand out.

Banking Ambitions and Fee Disruption

As a licensed bank in Europe since 2017, Klarna has been partnering with WebBank in the U.S. but aims to secure its license. “We want to accelerate our money transmitting licenses,” Siemiatkowski told CNBC in December 2024, pledging $1 billion to challenge “horrendous credit card fees” Americans face. With merchant fees (3.29%–5.99% per transaction) driving most of its revenue, Klarna’s U.S. banking push could diversify income and disrupt traditional finance—if regulatory hurdles are cleared.

What’s Next for Klarna and Investors?

Backed by Sequoia Capital, Atomico, and SoftBank’s Vision Fund, Klarna’s IPO—slated for April 2025—could raise over $1 billion, funding growth and U.S. ambitions. But risks abound: market swings, consumer confidence, and a crowded BNPL field. A successful debut could signal a fintech IPO revival, while a stumble might highlight valuation and regulatory concerns. As Siemiatkowski steers Klarna toward its NYSE moment, the stakes are high for this Swedish upstart to reclaim its pandemic-era glory. Watch for updates as the SEC review unfolds.