On Thursday, March 20, 2025, Klarna, the Swedish buy now, pay later (BNPL) giant, announced a landmark partnership with DoorDash, marking the delivery platform’s first BNPL alliance in the U.S. This move, coming just days after Klarna filed its IPO prospectus for a New York Stock Exchange listing under the ticker KLAR, underscores the company’s accelerating push into everyday spending categories. With a $15 billion valuation in sight and a 24% revenue surge in 2024, Klarna’s latest deal signals robust momentum for investors eyeing its April debut. Here’s why this partnership matters and what it means for Klarna’s future.

DoorDash + Klarna: A New Way to Pay

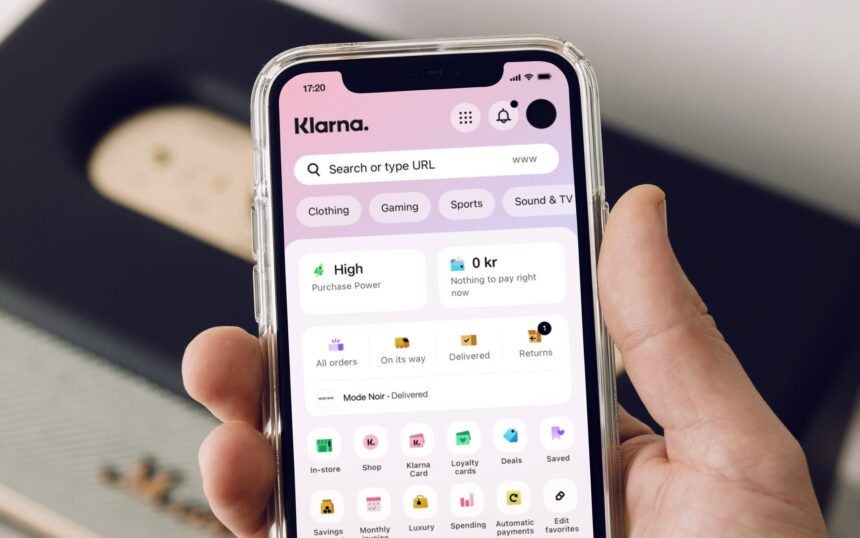

The partnership integrates klarna’s flexible payment options into DoorDash’s checkout process, giving U.S. customers three ways to pay for meals, groceries, and more:

- Pay in Full: Settle the bill immediately via Klarna’s seamless system.

- Pay in 4: Split costs into four equal, interest-free installments over weeks.

- Pay Later: Defer payments aligning with payday schedules, enhancing flexibility in cash flow.

David Sykes, Klarna’s chief commercial officer, called it “an important milestone in Klarna’s expansion into everyday spending categories,” highlighting its appeal for DoorDash’s 37 million monthly active users. As DoorDash’s inaugural BNPL partner in the U.S., Klarna taps into a $13 billion food delivery market, per Statista, broadening its reach beyond retail giants like Walmart, where it recently became the exclusive BNPL provider for OnePay.

Timing Is Everything: Pre-IPO Momentum

Klarna’s DoorDash deal comes hot on the heels of its SEC filing on March 14, positioning it as one of 2025’s most anticipated tech IPOs. After a slow stretch for new offerings—interrupted only by Reddit, ServiceTitan, and CoreWeave—Klarna’s $2.8 billion 2024 revenue (up 24%) and $181 million adjusted operating profit (from a $49 million loss) signal a comeback from its $6.7 billion 2022 valuation low. Analysts estimate a $15 billion IPO valuation, a far cry from its $46 billion peak but a testament to its resilience.

Posts on X reflect investor buzz: @007ofWallSt noted DoorDash’s move as “retail’s growing dependence on credit,” while @vaultedmag praised Klarna’s strategic timing. With 675,000 merchant partners across 26 countries, including recent wins like Walmart and now DoorDash, Klarna’s painting a compelling picture for public market investors.

Why DoorDash? Expanding BNPL’s Everyday Reach

DoorDash, commanding 63% of the U.S. food delivery market per Earnest Analytics, is a high-traffic platform for Klarna to penetrate daily transactions. Unlike one-off big-ticket purchases, food delivery is habitual—think $30 sushi orders or $50 grocery hauls—making BNPL a frictionless fit. “By offering smarter, more flexible payment solutions for takeout and essentials, we’re making convenience even more accessible,” Sykes said. This aligns with Klarna’s goal to challenge “horrendous credit card fees,” as CEO Sebastian Siemiatkowski told CNBC in December 2024, with a $1 billion U.S. banking license push underway.

Yet, critics on X, like @davidhenkes, flag risks: “Going into debt to order restaurant delivery? Seems like an indication of where our economy is right now.” With consumer sentiment at 57.9 in March (below the expected 63.2), per University of Michigan data, some see BNPL as a debt trap for cash-strapped users—a tension Klarna must navigate.

Competitive Edge in a Crowded Field

Klarna’s DoorDash coup intensifies its rivalry with Affirm (Walmart’s ex-BNPL partner) and Block’s Afterpay, acquired for $29 billion in 2022. Block’s FDIC-approved lending and Afterpay’s Cash App integration show BNPL’s evolution into full-suite financial players. Klarna, with 93 million active users and a licensed European bank since 2017, counters with scale and merchant clout—575,000 partners dwarf Affirm’s 279,000. DoorDash’s deal, atop Walmart’s, could tip the scales as Klarna eyes U.S. dominance.

What’s Next for Klarna and Its IPO?

As Klarna barrels toward its April 2025 NYSE debut, the DoorDash partnership is a flex of growth potential. A successful rollout—expected in “coming months” per DoorDash—could lift its $1 billion+ IPO haul, funding U.S. expansion and banking ambitions. But volatility looms: the Nasdaq’s four-week slide through March 13 reflects tariff jitters under Trump’s second term. Klarna must prove its BNPL model thrives amid economic flux and sidesteps “phantom debt” critiques.

For now, this deal cements Klarna’s pre-IPO narrative: a fintech phoenix rising from 2022’s ashes, poised to redefine payments. Will it deliver for DoorDash users and Wall Street alike? Q1 earnings post-IPO will tell. Stay tuned as KLAR nears its big day.