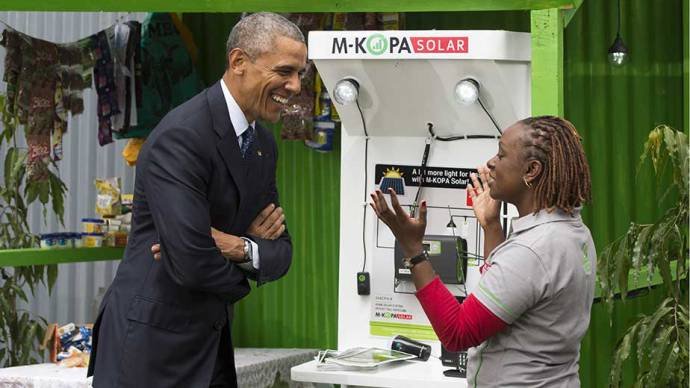

M-KOPA, one of the African fintech giants is reshaping the financial industry across sub-Saharan Africa and is enhancing and changing lives. Fueled by a massive salesforce of over 30,000 agents and innovative asset financing solutions, it’s one of the African finest.

M-KOPA, a pay-as-you-go platform providing asset financing to underbanked Africans, is on track to hit a significant milestone: surpassing $400 million in annual recurring revenue (ARR) by the end of the year.

This comes as the company builds on its customer base, which grew from 4 million in 2022 to 5 million today.

Headquartered in London, M-KOPA has demonstrated remarkable resilience in the face of economic challenges such as inflation and currency devaluations across African markets. Its ARR jumped from $248 million last year, showing that even in tough times, its business model is not just surviving but thriving.

The innovative payment structures and a strong distribution network made its financial services accessible to 90% of Africans earning daily wages instead of fixed salaries.

A Proven Model for Growth and Profitability

M-KOPA’s innovative financing model allows customers to purchase productive assets—such as smartphones, electric bikes, and microloans—through daily micropayments.

This flexible system has enabled the company to achieve profitability in four key markets: Kenya, Uganda, Nigeria, and Ghana. South Africa, where the company launched operations a year ago, has emerged as its fastest-growing market, according to Mayur Patel, M-KOPA’s Chief Commercial Officer.

What sets M-KOPA apart is its ability to maintain stable loss rates—around 10%, slightly lower than regional banking averages—while scaling its business.

The company attributes this stability to the nature of the financed assets, which play a crucial role in its customers’ ability to earn a living and participate in the digital economy.

Our loss rates have remained remarkably stable over the past four years despite significant scaling and macroeconomic changes. — M-KOPA

M-KOPA’s flexible daily payment model, where smartphone customers pay as little as 50 to 60 cents a day after an initial deposit, has enabled millions to build credit histories for the first time.

In markets where formal credit is often inaccessible due to limited financial profiles and lack of collateral, this model has proven transformative.

Beyond phones, the company is expanding into higher-value assets, such as electric bikes, which it claims save customers up to 30% of their daily income.

Key to this growth has been M-KOPA’s ability to scale its sales and distribution network. Its 30,000-strong direct sales team—the largest in sub-Saharan Africa—plays a pivotal role, in reaching underserved communities and setting up payment schemes for customers.

This network has grown tenfold in just four years, illustrating the company’s commitment to grassroots-level financial inclusion.

From Solar Power to Smartphones and Beyond

M-KOPA’s journey began with solar power systems, a product line that achieved significant success with over a million units sold. However, the company has since shifted focus to smartphone assembly and electric vehicles.

Last year, M-KOPA launched a smartphone assembly plant in Nairobi, the largest in sub-Saharan Africa, producing over 1.5 million X-Series phones. These devices serve as a gateway to additional services like micro-loans and insurance, creating a digital ecosystem for its customers.

While solar remains integral to the company’s identity, the shift to smartphone assembly demonstrates M-KOPA’s adaptability and forward-thinking approach.

“Our experience with solar-powered products gave us the operational expertise to establish the assembly plant,” said Patel. Now, we’re channeling that expertise into electric vehicles, which we believe hold immense potential.

A $1.5 Billion Credit Revolution

Since its inception, M-KOPA has deployed over $1.5 billion in credit, showcasing its role in expanding Africa’s credit market. The company’s success has attracted backing from major investors, including Sumitomo and Standard Bank.

Last year, it secured $250 million in funding, with $200 million in debt financing, and raised an additional $15 million this year. While speculation about an equity round lingers, M-KOPA’s trajectory positions it among Africa’s largest fintechs by revenue.

M-KOPA’s success can be attributed to its ability to integrate cutting-edge technology with offline distribution which has positively impacted the business.

Patel emphasized that this combination of innovation and grassroots engagement has been central to the company’s decade-long evolution. “Our story is about finding ways to better serve customers, reduce costs, and deliver value. The secret lies in blending world-class online technology with exceptional offline capabilities.”

As M-KOPA continues to expand into new markets and product categories, it sets a powerful example of how fintech can drive financial inclusion and economic empowerment in emerging markets. With a strong foundation and a clear vision, the company will continue to remain a transformative force in Africa’s financial ecosystem.